What’s in the blog?

This blog explains how a reverse mortgage can help senior citizens generate tax-free monthly income while continuing to live in their own home. It breaks down eligibility, loan value, interest rates, and what happens after the borrower’s lifetime – helping families understand whether this often-overlooked option is the right financial solution for ageing with dignity.

Table of Contents

A decade ago, the idea of elderly parents living alone was viewed as a ‘western problem’ — something distant, something that didn’t belong to Indian society. In our culture, ageing was supposed to come with the comfort of family, where one rightfully relies on kids and grandkids.

But today, especially in metro cities, this picture is changing. Quietly.

Children moving abroad, fast-paced careers, nuclear families, rising living costs, and a more mobile lifestyle are reshaping how we age in India. Some call it the natural outcome of a developing economy. Some blame westernisation. Others see it as cultural erosion.

As a finance professional, I see it differently. I see it as a financial challenge that can be anticipated, planned for, and managed with the right tools.

The good news is that India already has systems designed to support seniors who may find themselves financially alone, even if not emotionally. One of the most practical yet underutilised tools among them is the Reverse Mortgage Scheme, a financial safety net that can help seniors maintain dignity, independence, and a steady income.

What is a Reverse Mortgage Scheme?

Let’s start with understanding what a reverse mortgage is. A reverse mortgage is a unique loan designed for senior citizens who own a house. Unlike the traditional mortgage, where the borrower pays the lender, in a reverse mortgage, the lender (bank) makes a monthly payment to the borrower (homeowner).

In simple words, a reverse mortgage is a financial tool that gives elderly people the option to generate passive income by mortgaging their home to the bank. The best part is that they do not need to move out or transfer the ownership of their home to the bank.

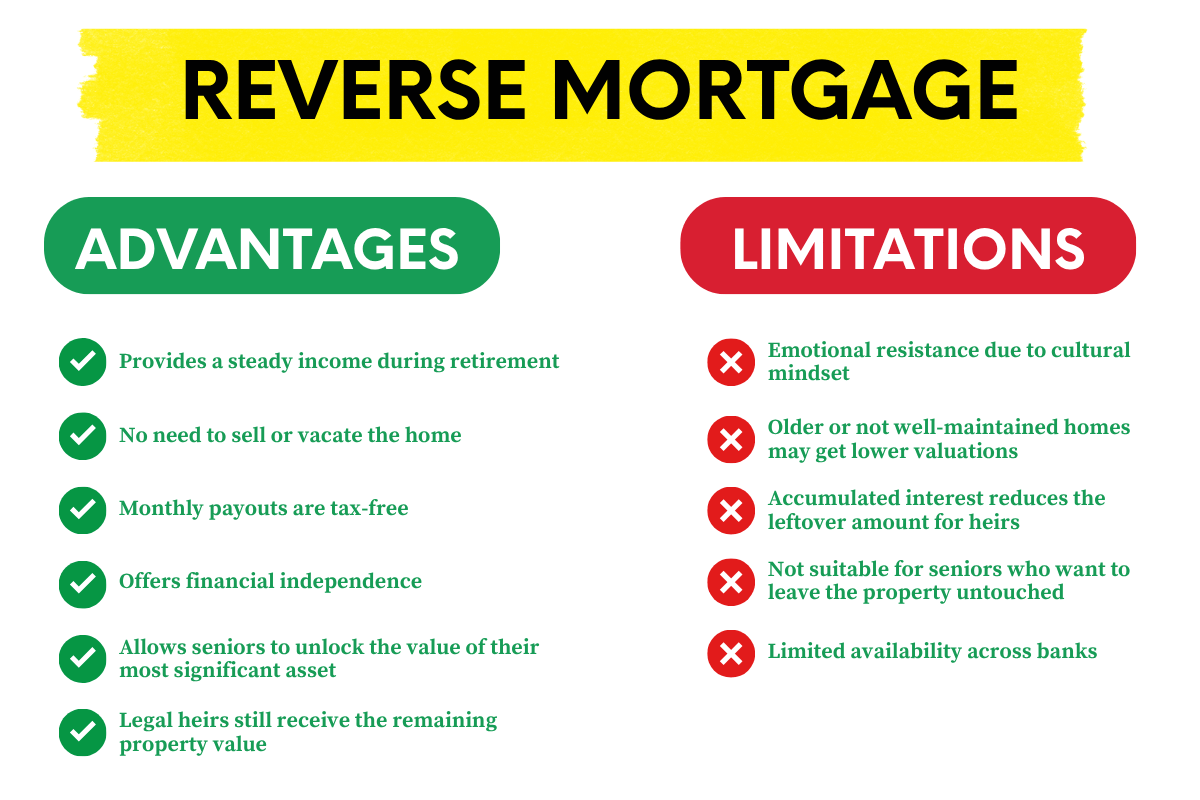

The benefits of a reverse mortgage are that the borrower:

- Continues to live in the house

- Retains full ownership

- Receives tax-free monthly payouts

The loan is repaid after the borrower’s death, usually through the sale of the property.

Who Can Apply for The Reverse Mortgage Loan?

With the above discussion, it might already be clear to you that this scheme is designed specifically for the elderlies. But what is the exact eligibility for the reverse mortgage loan?

The first eligibility criterion for the scheme is age.

- Single owner: Must be 60 years or older

- Joint owners:

- First applicant: 60+

- Second applicant: 55+

- First applicant: 60+

You must know that this scheme is designed specifically for the senior citizens of India. Non-resident Indians or foreign citizens are not eligible to avail the benefits of this scheme.

Apart from this, there are certain property requirements that must be fulfilled.

- The house must be self-occupied and residential

- It should have a clear title, free from legal disputes

There must be no existing home loan or mortgage on the property

How Much Can You Borrow Through a Reverse Mortgage?

Now, the next important question is how much someone can borrow through a reverse mortgage.

Needless to say, the loan value is influenced by the value of the property being mortgaged. The property’s age and condition affect the loan value. Older properties generally fetch lower loan values due to depreciation. Banks typically offer 60–70% of the property’s market value.

For example, if your home is valued at ₹2 crore, you may be eligible for ₹1.2–₹1.3 crore under the reverse mortgage scheme.

Factors influencing the loan amount include:

- Location of the property

- Structural age and condition

- Current market valuation

- Bank-specific policies

Other Important Aspects of a Reverse Mortgage

Apart from the eligibility criteria and loan amount, there are a few more aspects that you need to understand before deciding if you want to go with this or not. Let’s understand them one by one.

What is the tenure of the loan from a reverse mortgage scheme?

The exact tenure of the loan depends on the age of the primary applicant and the bank’s assessment of risk. However, most banks offer a tenure of 15-20 years.

What is the interest rate on a reverse mortgage loan?

Interest rates for reverse mortgage loans usually lie in the range of 10.5% to 11.75%. Interest gets added (compounded) to the outstanding loan amount as monthly payments are made to the borrower.

Does the borrower lose ownership status of the mortgaged property?

No, the borrower doesn’t lose ownership of their mortgaged property. They continue living in their home, continue maintaining it, and continue owning it.

The bank only steps in after the borrower’s death to recover dues.

Is there any tax implication on the amount received through a reverse mortgage?

One of the most powerful advantages of the scheme is that the monthly payments received from a reverse mortgage are completely tax-free. They are treated as compensation, not income, and hence are exempt from taxation.

However, if legal heirs later sell the property, capital gains tax rules apply.

What happens after the borrower’s death?

Once both borrowers pass away, the bank gets the right to sell the property to recover the principal + accumulated interest over the amount paid to the borrowers during the loan tenure.

The balance amount, if any, is given to the legal heirs. Moreover, the heirs also have the option to repay the loan themselves and retain the property.

Who Should Consider a Reverse Mortgage?

A reverse mortgage scheme is undoubtedly a nice scheme for those who need it. But, it might not be the ideal solution for every elderly person living alone.

A reverse mortgage can be ideal for:

- Seniors living alone

- Individuals without pension or family support

- Those who want regular income without selling their home

- Elderly homeowners who want to maintain independence and dignity

It may not be suitable for:

- Families where inheritance is emotionally important

- Very old properties with low valuations

- Seniors with other reliable income sources

My Take: Why Reverse Mortgage Matters Today

India is evolving — socially, emotionally, and economically. As more seniors find themselves living independently, their financial security becomes the foundation of their emotional well-being.

If you think deeply, a reverse mortgage is not just a loan. It is a dignity-preserving tool, allowing the elderly to stay in their own home, maintain independence, and receive a steady income without depending on anyone.

But the bigger message or takeaway from this blog should be that the best retirement plan is created decades before retirement. Early investing, disciplined saving, and thoughtful planning ensure that you never have to rely on your home for survival; instead, you enjoy it by choice.

If you are someone who needs financial guidance to secure your retirement with dignity, feel free to book a free call with me. I’ll be glad to help you.

Frequently asked questions (FAQ)

Yes. The monthly payouts can be freely used for medical bills, assisted living, home nursing, or any healthcare need. It totally depends on the borrower on how they want to utilise their money.

No. Even if the payout tenure ends, the borrower retains full rights to stay in the home for life. The bank cannot force eviction as long as the borrower adheres to basic terms like property maintenance and taxes.

Some banks allow periodic revaluations. If the property value has appreciated significantly, the borrower may be eligible for a higher monthly payout or a top-up facility. This depends on the bank’s policies.

Reverse mortgage payouts usually do not affect eligibility for government pensions or welfare schemes because they’re treated as loan compensation, not income.